Our Story

TRÉAN Group was founded in 2010, but the seeds of the dream were planted much earlier. Even before the Great Financial Crisis of 2008, three market veterans, Nancy Stubenrauch, Pete Kosanovich, and Stephen French, foresaw the need for a better model in futures’ clearing and execution services, knowing together they could provide a more cohesive and effective model than the current marketplace provided. The GFC and the ensuing breakdown of the previous clearing and execution framework confirmed what they had predicted. On the heels of the GFC Crisis, the founding of TRÉAN Group as an Independent Introducing Broker (IIB) in 2010 gave the team the ability to place client business with the most appropriate Futures Clearing Merchant (FCM), thereby best serving the client’s trading needs and financial concerns. The TRÉAN partners built their business on relationships and being a trusted solution provider for their clients; now, the firm was positioned to bring even greater resources while adding increasing value to their client proposition.

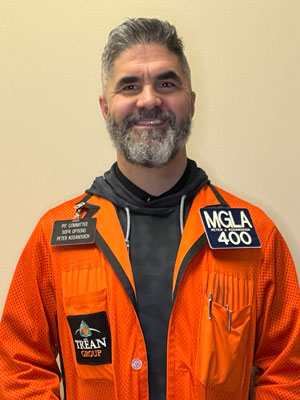

As a fully registered IIB with the National Futures Association (NFA), TRÉAN Group LLC has the ability to offer our clients the best fit for technology, capital, strategy, and trading among our various FCM partners; growth for TRÉAN has been steady and consistent, with every decision based on adding experts and increasing the firm’s ability to provide guidance at every step of the Exchange Traded Derivatives (ETD) process. By 2016, TRÉAN Group had industry experts in place across clearing, execution, and brokerage services. The next addition was adding direct institutional client advisory execution services; Matthew Carinato joined TRÉAN Group in 2016 to head this endeavor.

TRÉAN Group will always put clients first, listening to their needs and formulating a plan that best serves those mandates; we pride ourselves on delivering accurate, quick, and reliable responses throughout the trade process, all delivered from a single point of contact backed by the expertise and experience of our strong team. We believe integrity, trust, and education are imperative to maintaining client relationships, and we are always looking to enhance our services and expertise to give our clients an edge in today’s dynamic marketplace.